Finance

The Finance program offers a comprehensive, intensive, and rigorous curriculum for students who wish to pursue careers in corporate finance, investments, investment banking, financial analysis, personal financial planning, and other areas of the global financial services industry. Since 1970, over 35,000 alumni have graduated from this department and represent the largest number of African Americans on Wall Street. The Finance program offers students five concentrations within the major: 1) Actuarial Science; 2) Risk Management & Insurance; 3) Financial Planning & Wealth Management; 4) Investment Banking, Capital Markets & Trading; and 5) Investment Mangement & Alt Finance. Howard University is the only Historically Black College or University (HBCU) to offer an insurance concentration.

The department is also affiliated with the HPS Center for Financial Excellence.

Curriculum & Requirements

Degree Schemes, Requirements & Concentrations

View the scheme below based on the semester entering the Finance degree program. Refer also to the School's Academic Policies.

Finance BBA

Finance BBA with Concentration in Actuarial Science

Study mathematics, statistics and financial theory to quantify risks, especially related to investments, consumer demand, illnesses, and accidents while preparing to pass actuarial exams and work for consulting firms, insurance companies, and the government. Requires INSU 350, INSU 351, INSU 352, INSU 354, MATH 190 and MATH 193.

Finance BBA with Concentration in Risk Management & Insurance

Study a variety of subjects related to risk management and insurance with a focus on professional training requirements in the insurance and financial services industry to gain career opportunities in the business community and the government. Requires INSU 350, INSU 351, INSU 352 and INSU 354.

Finance BBA with Concentration in Financial Planning & Wealth Management

Study a variety of subjects related to financial planning and wealth management with a focus on professional training requirements in the financial services industry. Prepare for the Certified Financial Planning credential as offered by the CFP Board to gain career opportunities in the business community. Requires FINA 320, FINA 321, INSU 350, FINA 355 (tax course), and FINA 375 (Capstone).

For more information about the next steps to CFP, go to: https://dalton-education.com/university/howard-university

Finance BBA with Concentration in Investment Banking, Capital Markets & Trading

Study a variety of subjects related to investment banking, capital markets, and trading with a focus on professional training requirements in the financial services industry to gain career opportunities. Requires. FINA 325, FINA 365, and two courses from the recommended list of electives.

Finance BBA with Concentration in Investment Management and Alt Finance

Study a variety of subjects related to investment management and alternative finance with a focus on professional training requirements in the financial services industry to gain career opportunities. Requires. FINA 366, FINA 374, and two courses from the recommended list of electives.

Concentrations are an area of focus in the major discipline. Coursework is fulfilled through required major electives and included in the original 120 credit hour degree requirements. It does not appear on the official transcript.

Advising Worksheets

View the advising worksheet below based on the semester entering the Finance degree program. Refer also to the School's Academic Policies.

Finance BBA

Finance BBA with Concentration in Actuarial Science

Finance BBA with Concentration in Risk Management & Insurance

Finance BBA with Concentration in Financial Planning & Wealth Management

- Admitted Fall 2024 – Present

Finance BBA with Concentration in Investment Banking, Capital Markets & Trading

- Admitted Fall 2024 – Present

Finance BBA with Concentration in Investment Management and Alt Finance

- Admitted Fall 2024 – Present

Lists of Approved Electives

Purpose & Vision

Mission

Consistent with the missions of the School and University, the mission of the Finance BBA program is to provide a high-quality education in the fields of finance, real estate and insurance with a particular niche of assisting students to find a career path in the financial service industry, including commercial/investment banking, real estate and insurance. This program aims to prepare the next generation of minorities to work as financial experts and business executives.

Strategic Goals

- Understand time value of money concepts and their applications to capital budgeting and valuation.

- Analyze the relationships between risk and return for the development of a portfolio and making capital budgeting and investment decisions.

- Analyze and interpret the interrelationships between interest rates and financial securities.

- Develop, analyze, and use spreadsheets for financial analysis.

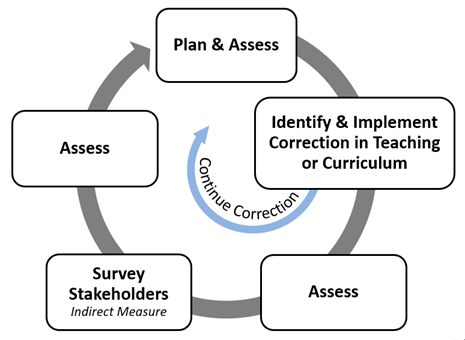

The HU School of Business follows a comprehensive and multi-faceted assurance of learning process in accordance with AACSB standards. All degree programs are assessed by direct measures on the “Business School Core Competencies” and respective “program learning goals” created by Department faculty. Assessment questions are created by faculty and distributed by the Office of the Associate Dean to seniors at the end of their matriculation. The Office of the Associate Dean then reports the data to the Department faculty, who will review and identify any improvement strategies based on the desired target. After implementation, and alongside any surveys determined necessary to any stakeholders, the Office of the Associate Dean will again send the original assessment questions to seniors at the end of their matriculation. Occurring on a staggered, 5-year cycle, this plan “closes the loop” in the year-to-year continuous improvement but also closes the larger “loop” by assessing across the 4-year matriculation cycle.